Missouri Floodplain Management/Floodplain Insurance Programs

Future Workshop Opportunities

Elevation Certificate Virtual Workshop

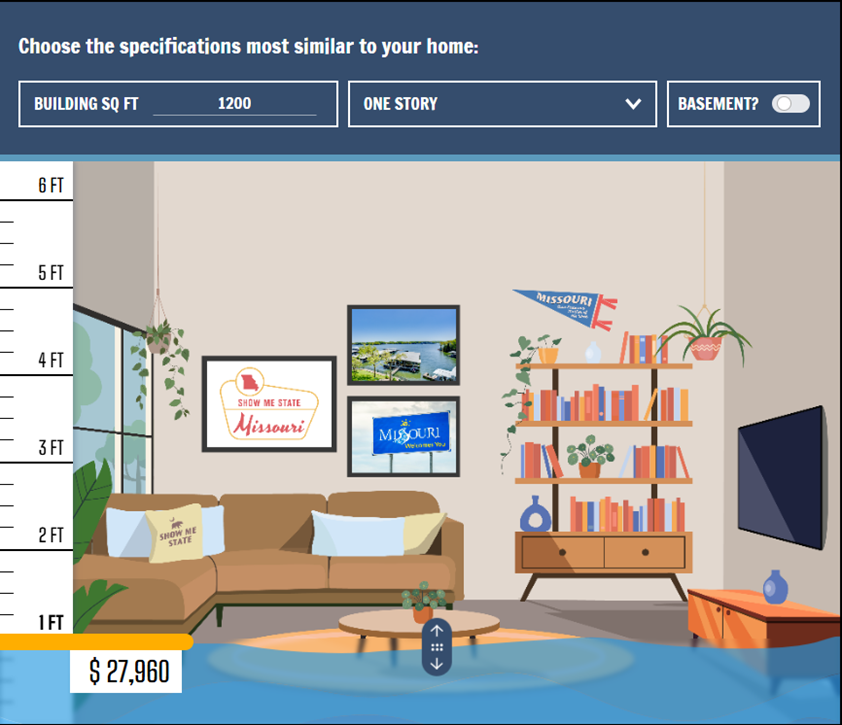

Missouri SEMA Flood Visualization Tool

The flood visualization tool presents a graphical representation of the flood depth and the associated damage estimate ($) for individual structures within the Special Flood Hazard Area. It allows the user to enter their structures square-footage, building type, and if they have a basement. The user is then able to change the depth of the flood water with a sliding scale. The tool will generate an approximate cost of repair, based upon the characteristics entered, data specific to Missouri structures, and the current mapped floodplains. When the user slides the scale up it will also tell the approximate the depth of water the structure can have before being determined substantially damaged. Click the link above to check on your structure!

What you should know about flood insurance

- Homeowners are 85% more likely to use a flood insurance policy during the span of a 30-year mortgage rather than a homeowner’s policy.

- More than 20% of NFIP claims are submitted by people who own property outside of high-risk areas.

- If you live in an area with a high risk of flooding, you have a 25% chance of your home being flooded over a 30-year mortgage. In moderate- to low-risk zones, the chance of flooding is lower but still present.

Source: National Flood Insurance Program figures for U.S.

Flooding is generally the most common and costliest type of disaster Missouri experiences, but standard homeowner’s insurance does not cover flooding, so it’s important to have protection from damage associated with flooding.

SEMA’s Floodplain Management Section administers the National Flood Insurance Program (NFIP) for the state of Missouri. NFIP offers flood insurance to homeowners, renters and business owners if their community participates in the program, providing more than $4 billion in flood insurance coverage for Missouri homes and business annually.

The National Flood Insurance Program was created by Congress in 1968 to provide a means for property owners to protect themselves financially from flood events. The program is administered by the Federal Emergency Management Agency.

Communities that participate in the NFIP agree to adopt and enforce floodplain management ordinances that meet or exceed FEMA requirements.

Missouri communities that have recently enrolled in the NFIP:

- Diggins 2025

- Olympian Village 2025

- Norwood 2024

- Iatan 2024

How NFIP Insurance Policies Helped Missouri Homeowners in Historic 2017 Flooding

- More than $64 million was paid to policyholders, with the paid-out claims averaging more than $63,500.00 per policy.

- $19 million was paid to policyholders BEFORE the federal disaster was declared (flood insurance pays even when there is no disaster declaration.)

- 26% of NFIP claims filed were NOT in a Special Flood Hazard Area.